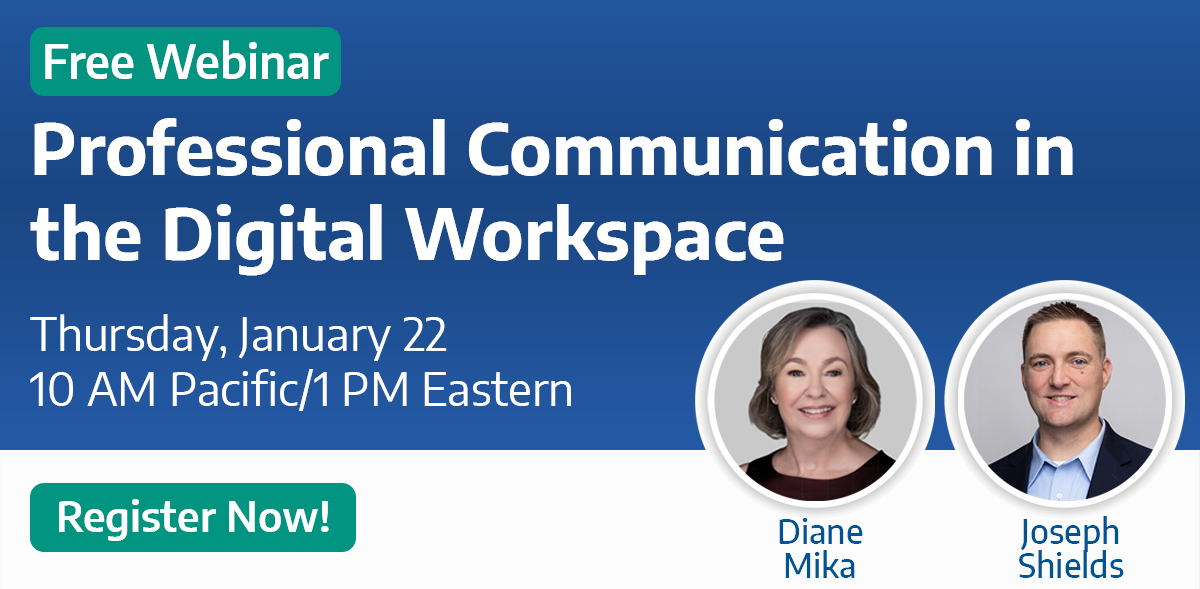

Presented by:

Diane P. Mika, Senior Vice President, Risk Management Officer, Berkley Alliance Managers

Joseph Shields, P.E Assistant Vice President, Director of Construction Professional Risk Management, Berkley Construction Professional

Thursday, January 22, 2026

10:00 a.m. Pacific Time

1.0 AIA Learning Unit

1 RCEP Professional Development Hour+